Login

Request a Demo

Login

Request a Demo

What are ESG Ratings and why do they matter?

Environmental, Social, and Governance (or “ESG”), has become a hot topic in the investment world. Investors are increasingly using “ESG” data to guide their decisions. To integrate the substantial volume of “ESG” data into investment considerations, there is a need to aggregate all the data into a unified framework. The result is an ESG score or rating, which would allow investors to easily compare and measure performance across companies. However, understanding ESG ratings isn't as straightforward as it seems. Many ESG data providers, each with their own methods and approaches, add complexity to the interpretations of these ratings.

AQTION’s parent company, SquareWell Partners, conducted a Progress Group on this very topic which included participants from the entire ecosystem ranging from MSCI to BlackRock to Schneider Electric to Morningstar. The report can be accessed here.

Think of ESG Ratings as report cards for companies, showing us how well they are tackling climate change, treating their employees, and practising ethical business. ESG ratings create a standardized framework for evaluating how a company handles “ESG” risks and opportunities compared to its peers.

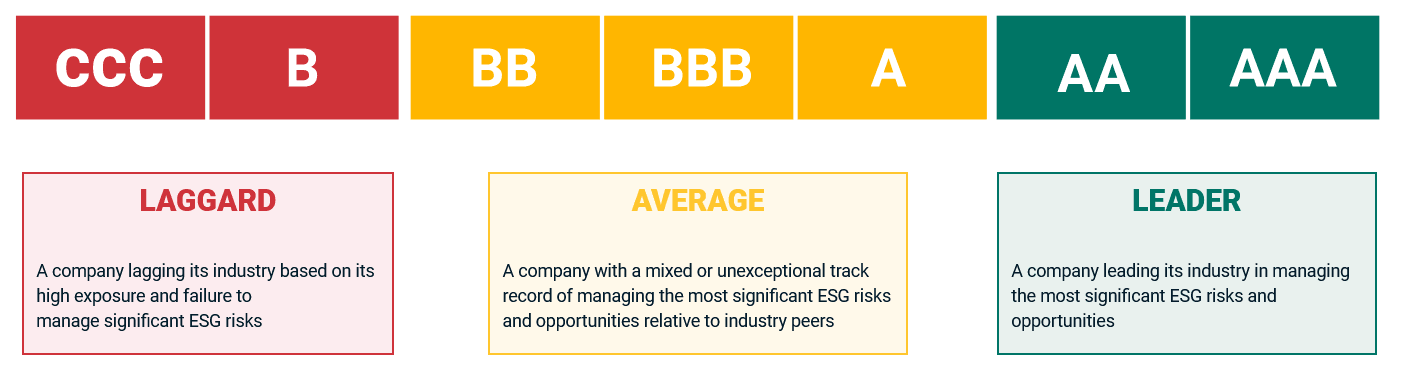

These ratings often use numerical or letter scales to give an overall assessment of a company's ESG performance and enables investors to make comparisons and choose companies based on a set of measurable criteria. Companies with higher ESG ratings are attractive to socially responsible investors, who see them as leaders able to best manage “ESG” risks and create long-term value.

No, they are not. With many ESG data providers in the market, each with its distinct methods, materiality considerations, industry classifications, and metrics, the same company could end up with different ratings. This adds complexity to the “ESG” landscape, so it’s important to look beyond the rating and understand the company’s unique “ESG” story.

Some investors rely solely on ratings from one to few data providers, while others dive deeper, using the data behind the ratings to create their proprietary rating tool. We have seen investors cooking up their own ESG frameworks, like the ones below from the AQTION database:

MSCI defines an “ESG” controversy as “an event or an ongoing situation in which company operations and/or products allegedly have a negative environmental, social and/or governance impact.”

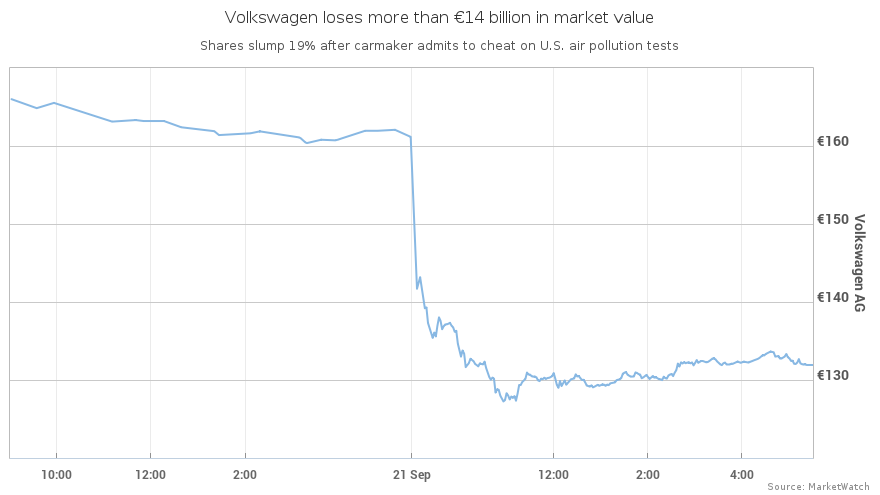

Controversies can include alleged or actual events such as environmental violations (e.g., spills), labour disputes, or ethical misconduct (e.g. corruption, tax frauds). These events pose reputational, financial, and regulatory risks, exposing weaknesses in the company’s operations and governance, which, in turn, can impact the company’s stock performance and bottom line.

Given the potential impacts, controversies may trigger a score change, or even re-rating. Serious events like corruption or high-profile cases may stay on file for a long time even if the issue has been rectified.

Most rating agencies monitor daily media and governmental sources to identify controversies. While they might not check every claim, some, like ISS-ESG, may initiate fact-finding dialogues with companies and stakeholders (e.g., government representatives, NGO, academia) with the aim to dismiss unfounded allegations. ISS-ESG also allows companies to review the draft reports for significant controversies and provide feedback before they are published.

ESG controversies can have a significant impact on share prices as seen in this example of Volkswagen in 2015.

ESG rating agencies collect data from various sources, including company disclosures found in the annual report, sustainability report, and proxy report, as well as government data, NGO reports, academic datasets, and media searches. One important note for companies is that any information they would want ESG rating agencies to consider would have to be public information.

Usually once a year, though the frequency may vary among providers. Events and controversies are updated more often.

Companies typically have the chance to review the draft of the ESG ratings report before publication. Some rating agencies such as MSCI may arrange calls for more in-depth discussions, whereas ISS-ESG is known to have comprehensive dialogues with companies once every two to three years.

In the last 5-10 years, there has been a wave of mergers and acquisitions, with traditional agencies like ISS, Moody's, and S&P Global absorbing smaller independent research firms. You will notice that many of the current market players are credit agencies (Moody’s, S&P, Fitch), benchmark/index administrators (MSCI, FTSE Russell), and data vendors like Bloomberg and Refinitiv who expanded into the ESG data and research. “ESG” research also benefits from the rise of artificial intelligence, represented by AI-driven data vendors such as RepRisk and TruValue Labs.

According to AQTION’s latest study “Stewardship in AQTION”, MSCI, Sustainalytics, Bloomberg ESG, ISS-ESG, and Trucost are the preferred providers among the largest 65 asset owners and asset managers.

MSCI is a benchmark administrator and provides indices to index funds, including “ESG” ones. MSCI’s ESG business grew after acquiring smaller independent sustainability and governance data providers RiskMetrics, GMI Ratings, and Carbon Delta between 2010 and 2019.

MSCI ESG Ratings measures a company’s exposure and management of financially relevant “ESG” risks and opportunities. The assessment covers 1,000 data points across 35 ESG Key Issues. Key Issues are selected for each industry based on MSCI’s materiality mapping framework.

Measured in relative to industry peers, MSCI ESG Ratings puts companies on a scale from Leader (AAA, AA), Average (A, BBB, BB), to Laggard (B, CCC). MSCI ESG Ratings cover over 10,000 companies, the public ESG Ratings search tool gives you free access to the ESG ratings of 2,900 companies that make up the MSCI All Country World Index (ACWI).

Public scores are available on: https://www.msci.com/our-solutions/esg-investing/esg-ratings-climate-search-tool/

Sustainalytics is owned by Morningstar (acquired in 2020). Sustainalytics collaborates with various ESG index providers such as FTSE Russell, Morningstar STOXX, and S&P, and offers second-party opinion on bond and loan issuance.

Sustainalytics measures a company’s exposure to industry-specific material ESG risks and how well a company manages them. Sustainalytics cover 1,300 data points across 20 material ESG issues.

Companies get a score from 1 to 100, and then they're sorted into five risk categories: negligible (0-10), low (10-20), medium (20-30), high (30-40), and severe (40+). The scale is absolute, showing the level of risk across the board, no matter the industry.

Sustainalytics' ESG Risk Ratings cover more than 16,000 companies across 42 industries.

Public scores are available on: https://www.sustainalytics.com/esg-ratings

ISS-ESG is the responsible investment arm of proxy advisor, ISS.

The ISS-ESG Corporate Rating was initially developed by the German research firm Oekom, which ISS acquired in 2018. A company’s “ESG” performance is determined by their ability to manage material “ESG” risks and capitalize on opportunities during the transition to a more sustainable economy.

This rating dives into a pool of 700 indicators with around 100 indicators applied to each company, of which 60% is industry-specific criteria. Focus is given to 4-5 material key issues per industry, making up around 50-80% of the rating weight.

ISS-ESG Corporate Ratings uses a rating scale from A+ for excellent performance to D- for poor performance. The ratings scales are absolute and independent of other in their industry groups. “Prime” status is reserved for industry leaders meeting specific Prime thresholds, C+ for low-risk industries, C for medium-risk industries, and B- for high-risk industries. Notably, companies in high risk and impact sectors, like oil and gas, must achieve a higher overall rating than those in low-risk sectors, such as real estate, to obtain the ISS ESG Prime status.

The assessment evaluates 7,800 companies each year.

Public scores are available on: https://www.issgovernance.com/esg/iss-esg-gateway/

The below provides a visual comparison of various metrics between MSCI, Sustainalytics and ISS ESG.

In 2016, S&P acquired Trucost, a specialist in climate and environmental data and risk analysis. The Trucost Environmental Register compiles information on the direct and supply chain environmental impacts of 15,000 companies. Environmental data, including greenhouse gas emissions, water usage, pollution, and waste, is collected annually from publicly disclosed sources such as sustainability reports and CDP responses.

Trucost provides carbon data to indices like the S&P Paris-Aligned & Climate Transition Indices and the S&P Global Carbon Efficient Index Series. Additionally, Trucost partners with CDP to help companies use Trucost’s environmental data to identify carbon intensive suppliers.

In contrast to traditional ESG rating agencies that heavily rely on analysts for analyzing corporate “ESG” performance, RepRisk, a Swiss data firm, harnesses the power of AI and machine learning to focus on risk incidents.

RepRisk uses AI for daily screenings, sifting through a vast array of sources—500,000 documents and 100,000+ public sources and external stakeholders. These include everything from international and local media, NGOs, governmental bodies, think tanks, blogs, and even Twitter (now called X). Notably, RepRisk intentionally excludes self-disclosures from companies for their process.

RepRisk research covers 165,000+ public and private companies across 34 sectors.

Their datasets play a crucial role in assessing controversies for some rating and data providers. For example, S&P Global ESG Research relies on RepRisk's compiled and pre-screened news stories.

Authored by: Carmen Ng, Director at SquareWell Partners.

Please complete this form to receive our insight by email.

All fields are mandatory***

One of our team members will get back to you shortly with the details for the document